Experiencing a disabling injury or an extended illness that keeps someone out of work can change their life. Health insurance covers medical bills but it won't cover other life expenses. Disability insurance is designed to replace a portion of an employee's income, when an injury sustained outside of work or a covered illness keeps them from employment.

According to the Social Security Administration, more than one in four 20-year-olds will experience a disability for 90 days or more before they reach age 67. Will you be able to go without a paycheck if this happens to you?

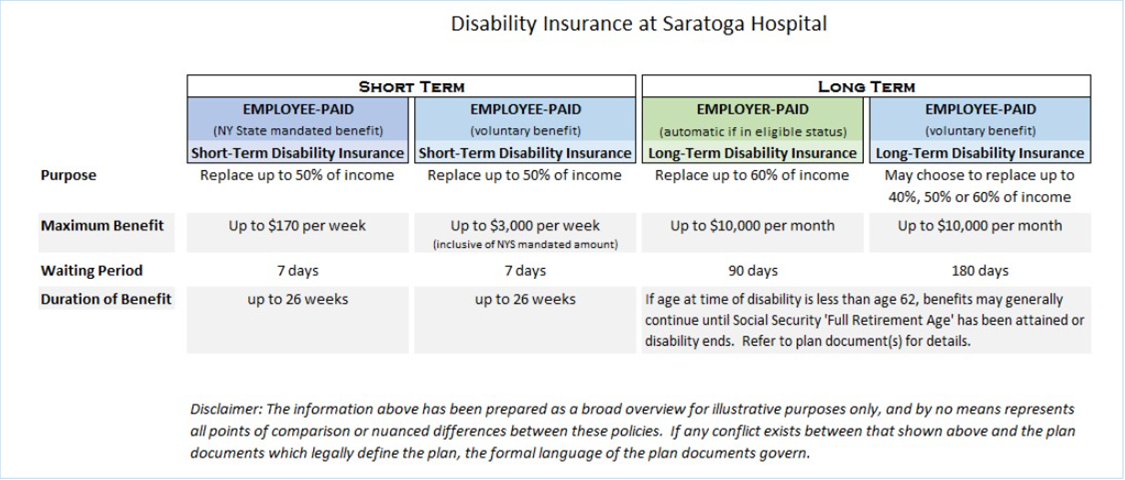

There are two main types of disability insurance, differentiated by the amount of time they cover.

Voluntary Short Term Disability

Short Term Disability Insurance (STDI) replaces a portion of an employee's income for covered illnesses or injuries sustained outside of work, common examples of which include Maternity Leave, broken bones or surgery recovery.

Voluntary Short Term Disability (VSTD) allows you to buy up from the NY-State Mandated Disability Insurance which offers $170 max per week benefit. With VSTD, you have the opportunity to increase your disability benefit to a true 50% of your average weekly wages with a maximum benefit of $3,000 per week. Remote workers working in another state are not eligible for NYS disability benefits.

Eligibility

- All full-time and part-time active employees

- 12 hour shift employees – must be scheduled to work at least 18 hours bi-weekly

- Non 12 hours shift employees – must be scheduled for at least 37.5 hours bi-weekly

Application

- All enrollments are subject to approval by the carrier

- This benefit can be applied for at any time through and Ultipro Life Event or during Open Enrollment. Coverage approval is not guaranteed and requires completion of an online Healthcare Questionnaire sent to your hospital email by the carrier.

Plan Information

- Short Term Disability Flyer

- Short Term Disability Insurance Benefit Highlights

Voluntary Long Term Disability

Long Term Disability Insurance (LTDI) replaces a portion of an employee's income when they are absent from work for a covered disability for an extended period of time, beyond what might be covered by short-term policies. Common examples include heart attack, stroke, scoliosis, complications from pregnancy or back pain.

As an employee of Saratoga Hospital, your employment status determines whether you are eligible for coverage paid by the hospital. Voluntary coverage is also available.

Employees may choose from a monthly benefit which replaces 40%, 50% or 60% of their average monthly wage. The elected amount - up to a maximum benefit of $10,000 per month - will be provided following a 180-day waiting period.

Eligibility

- All full-time active non-salaried employees working at least 36 hours weekly and all full-time active non-salaried employees per employment agreement who are Physicians, Physicians Assistants and Nurse Practitioners who work at least 30 hours weekly

Application

- All enrollments are subject to approval by the carrier

- This benefit can be applied for at any time through and Ultipro Life Event or during Open Enrollment. Coverage approval is not guaranteed and requires completion of an online Healthcare Questionnaire sent to your hospital email by the carrier.

Plan Information